Credit Research & Business Reports

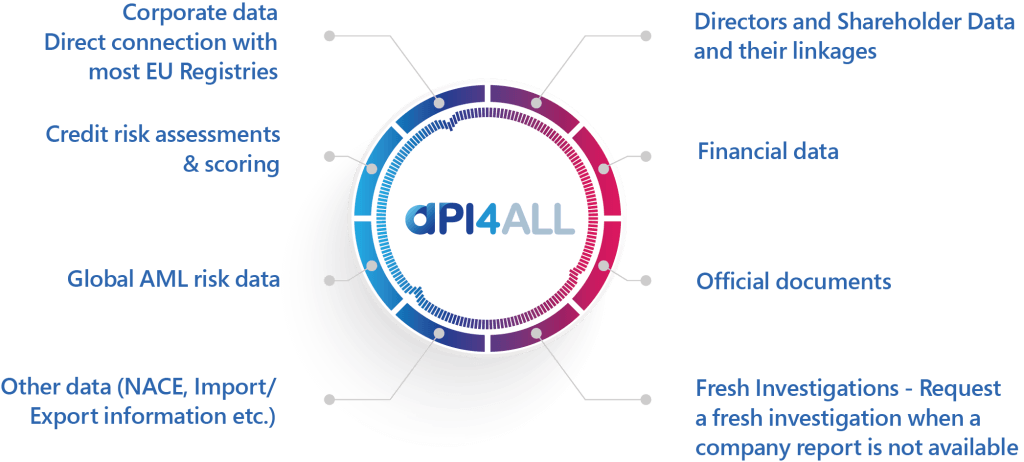

Obtain critical business intelligence in the form of credit reports, industry analysis or relationship reports and more which examine company structures, entity relationships, operations, and financial health.

Credit Assessment & Risk Scoring

Evaluate the creditworthiness of your prospective business partners and assess their ability to honor their financial obligations, based on their transactional behavior as well as historic detrimental information (e.g. bankruptcies/ insolvencies, court orders, bounced cheques and overdue invoices).